AwanTunai Grabs Over 811 Billion Rupiah in a Form of Equity and Loan

AwanTunai is building a credit scoring system for MSMEs can get access to loans from banks

Fintech lending startup AwanTunai confirmed the series A2 funding that the company had obtained amounting to $56.2 million (more than 811 billion Rupiah) in the form of equity and loan facilities. Equity funding of $11.2 million was provided by BRI Ventures and OCBC NISP Ventura as new investors, participated also Insignia Ventures and Global Brains as previous investors.

Meanwhile, a loan facility of $45 million was provided from Accial Capital and Bank OCBC NISP. This is a top up loan provided from the bank which has disbursed a facility worth more than $45 million.

In an official statement delivered today (27/8), AwanTunai's CEO, Dino Setiawan said this fresh funding will be used to finance the company's domestic expansion, therefore, more micro MSMEs are empowered with fast and affordable access to financing.

He continued, the company is currently building a data infrastructure for digitizing online inventory purchase transactions. The data is effective for credit risk management and opens up opportunities for micro MSMEs that previously had minimal access to working capital from banking institutions already partnered with Awan Tunai.

"We expectAwanTunai to become a platform that allows the banking industry to reach millions of traditional MSMEs that previously had difficulty obtaining services," he said.

As a new investor in this round, BRI Ventures provide a statement. BRI Ventures' CEO Nicko Widjaja said, AwanTunai has a customer profile similar to Bank BRI. By empowering micro merchants, they have supported small businesses maintain and grow their businesses in these difficult times.

"We expect to further collaborate with AwanTunai to reach underserved MSMEs," Nicko said.

In addition to providing digitalized services for inventory order, payments and consumer management for traditional wholesalers and retailers, AwanTunai's platform also provides financing for purchasing supplies to suppliers of fast moving consumer goods (FMCG) and micro traders of everyday groceries.

Micro MSMEs can purchase their inventory online through the AwanToko mobile application and access affordable financing through a simple process of registering with an Identity Card (KTP).

As of June 2021, the company has collaborated with more than 160 supplier partners to help traditional wholesalers digitize and finance their businesses. As well as, providing financing for purchasing supplies and integrated online ordering for micro MSME stalls consumers through the AwanToko mobile application.

AwanTunai has served more than 8,000 micro merchants as users, with an increasing number of users coming from tier 2 and 3 cities in Indonesia.

AwanTunai's position in the fintech lending industry is quite unique, they focus on providing funding access to small retail entrepreneurs such as warungs. The main product is AwanGrosir for supplier financing, helping shop owners to be able to make payments to distributors on time. In this system, AwanTunai also provides point of sales facilities to help business owners manage transactions.

There is also AwanToko, the product focuses on helping shop owners with lack of capital to increase their stock of goods. The loan is facilitated through AwanTempo — all of the financing is in the form of goods. Shopping is available through the Wholesale Agent Store, which contains a fairly complete network of partner distributors.

Productive financing trend

According to the survey results summarized in the report "Evolving Landscape of Fintech Lending in Indonesia" by DSInnovate and AFPI, 75% of survey respondents (146 fintech lending players) work in the productive lending sector. While 53% play in the consumptive sector and 6.8% in sharia. However, one platform may have more than one business model.

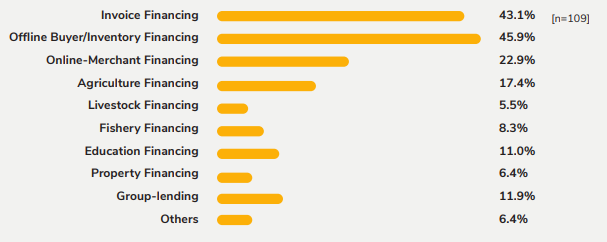

Of the total players who play in the productive sector, the majority sell services through invoices and inventory financing — also to suppliers is included.

Productive funding variants presented by many fintech lending players / DSInnovate - AFPI

Productive funding variants presented by many fintech lending players / DSInnovate - AFPI

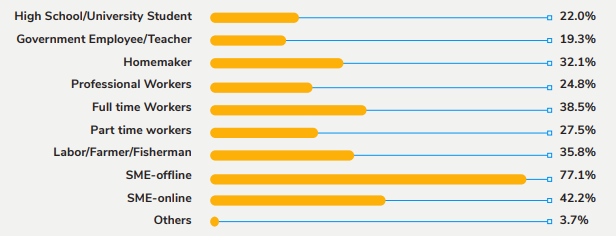

The productive sector is clearly more promising, especially now that there are around 59.2 million MSMEs spread across Indonesia, this is reflected in the profile of the majority of borrowers in these services (offline and online MSMEs). The issue of capital is still one of the most significant because bank credit facilities have not fully accommodated these needs.

The borrowers profile who use productive loan services / DSInnovate - AFPI

The borrowers profile who use productive loan services / DSInnovate - AFPI

The average loan application is 2.5 million Rupiah to 25 million Rupiah. Although some platforms offer fantastic loans of hundreds to billions of rupiah. The distribution of more than 90% is still around Jabodetabek and Java, although the new regulation will encourage fintech players to prioritize access to loans to other areas as well.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium