Modalku Group Obtains Additional 256 Billion Rupiah Debt Funding

The company is also reported to have received additional equity funding from Mitsui Banking Corporation worth $15 million

The Modalku Group announced $18 million (over 256 billion Rupiah) debt funding from a syndicate led by three financial institutions, Helicap Investments, the Social Impact Debt Fund (managed by Taurus Wealth Advisors), and a Japan based financial services group. This round is part of the company's current debt funding target to raise $120 million.

These debt funds will be redistributed to finance MSMEs in the four countries where Modalku Group operates.

Separately, based on DailySocial.id's source, Sumitomo Mitsui Banking Corporation (SMBC) channeled equity investment in a Series C round for Modalku worth of $15 million (over 213 million Rupiah).

Previously, in April 2020, the Modalku Group announced a series C equity funding worth of $40 million from a number of investors, including Softbank through the Growth Acceleration Fund, BRI Ventures, and Sequoia through SCI Investments.

In an official statement, through this debt funding, Helicap Securities acts as the main board with a single mandate, along with funding received from impact investors from Europe, such as Triodos Investment Management which has been Modalku's institutional lender since late 2019.

Modalku's Co-founder and CEO, Reynold Wijaya said, the Covid-19 pandemic is an important test for Modalku Group's resilience and he is grateful to have successfully passed it, one way is by using a credit model based on Artificial Intelligence (AI).

"We will use the funds to continue developing the digital lending sector for SMEs. We believe that this is the beginning of a long-term relationship and will consistently drive the evolution of the company going forward," he said, Thursday (7/10).

Helicap Pte. Ltd.'s Co-founder and CEO, David Z. Wang added, Helicap was established aiming to break down barriers for those in need for capital and those who can provide venture capital. This transaction proves that the interest and ability of individuals and institutions for financing opportunities through private loans remains and is sustainable.

“Helicap is in the right position to provide access to quality loans through our relationships with well-known lenders such as Modalku Group,” he said.

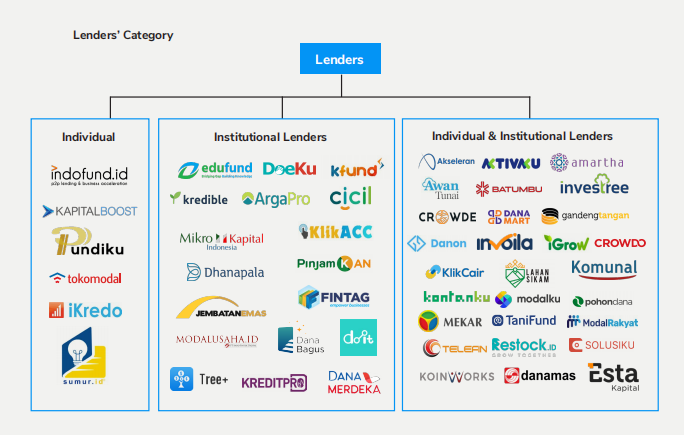

Modalku Group was founded in 2015 as a p2p lending startup that provides business loans for MSMEs. Companies use technology to support creditworthy MSMEs, but do not have access to financial services. More than 50% of each ASEAN member country's GDP is MSMEs contribution, however, as many MSMEs have no history of credit scoring, their application for business loans usually rejected by traditional lending institutions.

The Modalku Group provides easier access to funding using alternative data points, including but not limited to MSME cash flows (which indicate their ability to repay loans), to approve loans.

In early February 2021, Modalku Group announced its expansion to Thailand after securing a loan crowdfunding license from the Thailand Securities and Exchange Commission (SEC). By using the Funding Societies brand, such as its operations in Malaysia and Singapore, the company wants to solve the challenge of 3 million MSMEs which business is hampered due to the difficult access for business loans, especially short-term loans.

The issue is similar to Indonesia as conventional financial institutions are more focused on long-term loans and loans without collateral.

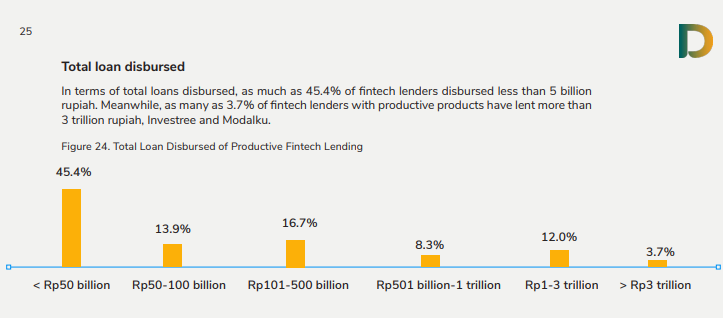

It's relatively low on productive sector

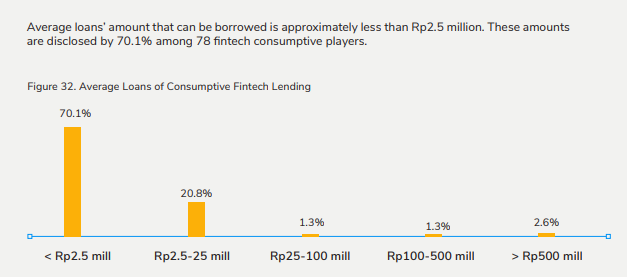

According to DSResearch and AFPI report, as many as 36.1 million borrowers in the productive sector borrowed Rp. 2.5 million to Rp. 25 million. Only 17.6% of them borrowed more than Rp500 million last year. This sector still require improvement by regulators, especially during this pandemic, many MSMEs are negatively impacted and have to survive.

Sign up for our

newsletter

Premium

Premium