Payment Startup Durianpay Secures 28 Billion Rupiah Funding Led by Surge

As a payment aggregator, Durianpay works closely with several payment gateways and fund transfer providers to build solutions for various types of businesses

Payment solutions startup Durianpay announced $2 million (over 28 billion Rupiah) funding led by Surge from Sequoia Capital India. Also participated in this round AC Ventures, Kenangan Fund, and a series of angel investors. They are including Ankiti Bose (Zilingo), Ankit Jain, Harshet Lunani (Qoala), Joe Wadakethalakal (ex-Brilio), Reynold Wijaya (Modalku), Sai Srinivas (MPL), and Tanay Tayal (Moonfrog).

Durianpay is to channel the fresh funds to develop more solutions and deepen its business penetration to reach more users.

Durianpay is a one-stop payment provider that enables businesses to grow and thrive through a one-stop solution for seamless checkout, APIs and modern dashboards that are easy to integrate. This startup was founded by Antara Sara Mathai, Kumar Puspesh, and Natasha Ardiani in September 2020 in Jakarta.

The three have deep backgrounds in the fintech industry. Mathai used to lead the product team at Citrus Pay and OnlinePajak. While Puspesh was previously the founder of Moonfrog, an India based game development company. Also, Natasha has experience leading ShopeePay, Shopee PayLater, and OVO's loan and collection business.

“Durianpay offers a one-stop solution for businesses in the region to better manage its payment processes. We built our payment products and solutions with both business and developer comprehension, with a vision to modernize payments by providing a secure and customizable next-generation product experience," Durianpay's Co-Founder Natasha Ardiani said in an official statement, Thursday (12/8).

The increasing e-commerce transaction

This service was initiated as the recent significant increase of e-commerce transactions in the Southeast Asia region. However, it is not followed by the development of payment solutions, especially in Indonesia, which is still fragmented, manual, and yet to be optimal.

It causes a high drop off rate at checkout, verification and reconciliation processes for merchants that are still using manual system, prone to errors, and fraud.

The founders saw a significant opportunity for businesses of all sizes to benefit from an easy-to-operate, fully integrated and whole payment system. Durianpay as a payment aggregator works with several payment gateways and fund transfer providers to build solutions for various types of businesses.

For example, automatic reconciliation features, instant payment links, promos, and other features that aim to optimize transactions between sellers and buyers. Through a single integration, Durianpay offers businesses and developers access to a wider range of payment options, a codeless interface, therefore, businesses can create workflows that deploy automatic payment infrastructure.

Checkouts and payments are now fully customizable directly by merchants. Using this solution, businesses have the ability to change its payment infrastructure without external intervention. This includes the ability to connect third-party solutions for fraud detection, KYC, CRM, business intelligence directly into the system without additional burden on product, finance or tech teams.

Since the launching, Durianpay has been adopted by more than 15 businesses in Indonesia by leveraging innovations such as split payments and multi-branch settlement. Kopi Kenangan, Alta School, and Chilibeli are some companies that using Durianpay solution.

Durianpay is part of Surge's fifth cohort, consisting of 23 companies with developed state-of-the-art digital solutions that help companies and individuals in the Southeast Asia region. The company has headquarters in Singapore and Indonesia.

In the cohort, apart from Durianpay, participated also two other local companies. Those are Rara Delivery (revolutionary instant delivery for e-commerce brands) and Bukugaji/Vara (easy staff management platform for MSMEs in Southeast Asia).

Digital payment potential

One of the factors that forces businesses to adopt a system similar to Durianpay is the high adoption of digital payment services in the community. It is mostly to fulfill the daily needs, not a few people, especially in urban areas, are using digital wallets through their smart phones.

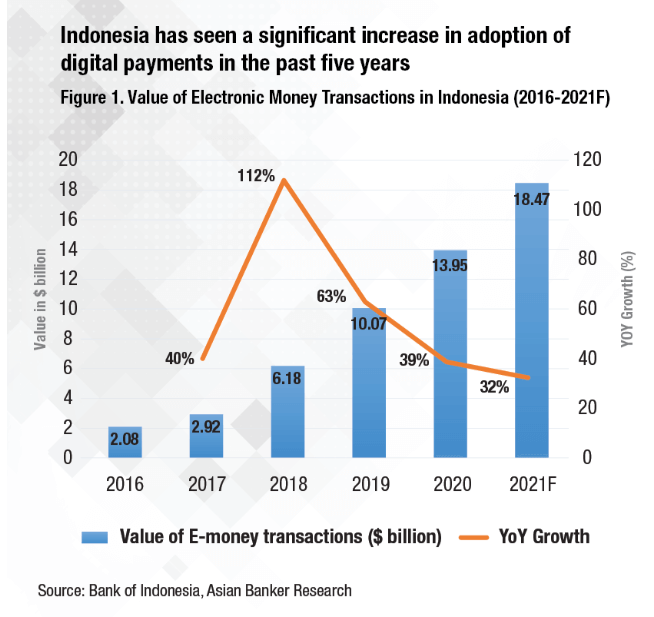

Based on data, the adoption of electronic applications in Indonesia also continues to increase from year to year - both in terms of adopters and the value of the transactions generated.

The increasing adoption of digital payments in Indonesia / Source: The Asian Banker

The increasing adoption of digital payments in Indonesia / Source: The Asian Banker

In terms of this potential, the fintech payment platform also continues to sharpen its products. Aside from Durianpay, other payment provider platforms have also been available in Indonesia. From Midtrans, which is now listed unde Gojek's financial group, also Xendit, Doku, Xfers (Fazz Financial Group), Faspay, and others.

Midtrans has recently introduced a Payment Link product to accommodate social commerce players to process digital payments by sharing a special link. Unlike the previous models which had to integrate APIs, users simply created a unique link to accommodate each payment.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium